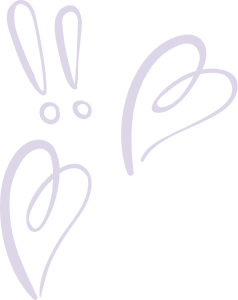

SEC Recent & Proposed Broker – Dealer Amendments – A Comprehensive Guide

We have an in-depth exploration of the SEC’s recent and proposed Broker-Dealer Amendments—a comprehensive guidebook decoding the intricate world of securities transactions and the evolving roles within the financial landscape. Here, we work through: 1. What are Broker-Dealers? 2. Impact of FINRA’s Regulatory Notice 23-02 3. SEC Proposes Amendments to Enhance Customer Protection Rule 4.

Learn More